- Arts & Culture 6205

- Business & Economics 675

- Computers 324

- Dictionaries & Encyclopedias 70

- Education & Science 76937

- Abstracts 73

- Astrology 4

- Biology 8

- Chemistry 4010

- Coursework 15556

- Culture 8

- Diplomas 316

- Drawings 1596

- Ecology 5

- Economy 81

- English 80

- Ethics, Aesthetics 3

- For Education Students 17651

- Foreign Languages 11

- Geography 3

- Geology 1

- History 88

- Maps & Atlases 5

- Mathematics 12624

- Musical Literature 2

- Pedagogics 19

- Philosophy 22

- Physics 15120

- Political Science 5

- Practical Work 59

- Psychology 65

- Religion 4

- Russian and culture of speech 8

- School Textbooks 7

- Sociology 9

- Summaries, Cribs 87

- Test Answers 160

- Tests 8753

- Textbooks for Colleges and Universities 32

- Theses 7

- To Help Graduate Students 14

- To Help the Entrant 38

- Vetting 382

- Works 13

- Информатика 8

- Engineering 872

- Fiction 708

- House, Family & Entertainment 84

- Law 128

- Website Promotion 70

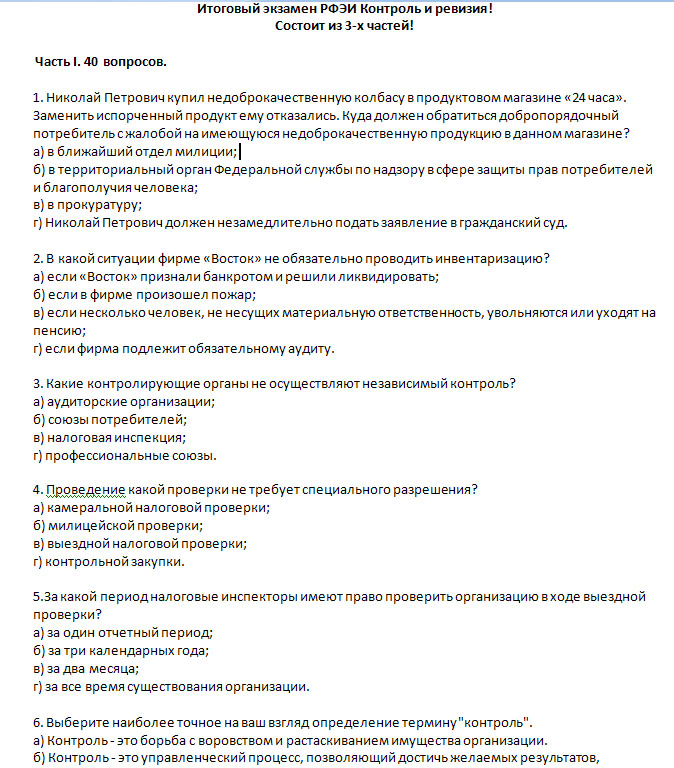

RFEI "control and revision" FINAL EXAM OF 3

Refunds: 0

Uploaded: 08.02.2011

Content: 10208105602327.rar 304,96 kB

Seller will give you a gift certificate in the amount of

Product description

The final exam "control and audit." Regional Financial - Economic Institute.

3 pieces.

Specifying + Ready.

Jobs surrendered.

Archived: Ready (pdf format and Word), Reference (in text form).

Everyone who buys can get free work action "to become an excellent student with us!".

Details of the action: http://rfei.ax3.net/page.php?11

Additional information

ISSUES

Part I. 40 questions.

1. Nikolai poor quality sausage bought at the grocery store "24 hours".

Replace spoiled food he refused. Where should a respectable consumer with a complaint about poor quality products available in the store?

a) to the nearest police station;

b) a territorial body of the Federal Service for Supervision of Consumer Rights Protection and Human Welfare;

c) the prosecutor;

d) Nikolai shall immediately apply to the civil court.

2. In what situation the company "East" is not necessary to conduct an inventory?

a) if the "East" declared bankrupt and decided to liquidate;

b) if there was a fire in the company;

c) if a few people do not bear financial responsibility, resign or retire;

d) if the company is subject to mandatory audit.

3. What are the regulatory authorities do not carry out independent monitoring?

a) audit organizations;

b) consumer associations;

c) the tax authorities;

g) trade unions.

...

Part II. 10 questions.

Question number 1:

JSC "bell" was late with the delivery of tax returns for 90 days, that is, for three months. The tax amount for the first month is 20 000, for the second - 13 500 rubles, and the third - 32 400 rubles. How much tax inspection shall be entitled to to punish the organization for such "late"?

Question number 2:

November 10 shop "Diva" has received a tax audit. The representative of the taxpayer (ie representative of the store as a legal entity) carefully studied the resulting act. As a result, he found that the act does not contain references to regulations, the provisions of which allegedly violated the shop. Can the taxpayer in this situation apply to the tax office with his objections? If so, then for how long?

Question number 3:

The grocery store 'Lunch "came the inspector Rospotrebnadzor. As always, he began his inspection to the control of purchase. Inspector under the guise of ordinary buyer asked him to weigh 400 gradlmov candy, half a kilo of oranges and two kilograms of apples. Seller obediently complied with the request, "the buyer". Once the inspector has paid for the purchase, the seller is struck check. After that, the alleged buyer showed his service certificate and an order to conduct checks. Then the inspector wanted to check to verify the correctness of weighing scales. It was found a buyer cheated by a total of 250 grams. Which is fine threatens the grocery store for such a "sell"?

...

Part III. 3 questions.

1. Specify career in which, in your opinion, the control is not in use. His answer Arguments.

2. Do you think that in our country there is the problem of corruption? If so, is it worth it to solve and how?

3. How do you think you need in our country tax control? Explain your answer.

Feedback

0| Period | |||

| 1 month | 3 months | 12 months | |

| 0 | 0 | 0 | |

| 0 | 0 | 0 | |